1. When Not to Use Your Primary Credit Card: Top 7 Situations Explained

1. When Not to Use Your Primary Credit Card: Top 7 Situations Explained

Quick Links

- Insecure Websites Without SSL

- When Connected to Public Wi-Fi

- Using a Shared Computer

- Unreliable Merchants or Shopping Apps

- Trial Subscriptions

- Overseas Transactions

- Crowded or Unsafe Locations

Using your main credit card for shopping can earn you benefits like cash back, but using it on insecure websites, with untrusted merchants, and similar situations can expose you to fraudulent or unexpected charges. To protect my finances, I always opt for an alternate payment method in these scenarios.

1 Insecure Websites Without SSL

Dibakar Ghosh / How-To Geek | Midjourney

SSL encryption ensures that data transmitted between your browser and the website’s server is secure and private. Without this encryption, hackers can intercept any data you enter. Because of this, using your primary credit card on an unsecured website puts your sensitive financial and personal information at risk of being compromised by malicious actors.

Hackers could steal credit card information and use it for unauthorized purchases or sell it on the dark web. They could also misuse other information you enter for identity theft. For this reason, ensure that the websites you transact with offer a secure connection , indicated by “https://“ at the beginning of the URL with a padlock or tune icon (in Chrome).

If you have to grab a deal only available on an unprotected website, try using an alternate payment method, such as a disposable credit card.

2 When Connected to Public Wi-Fi

Public Wi-Fi networks, such as those in airports or hotels, are often not secured properly, making them prime targets for cybercriminals. The lax security practices allow hackers to easily intercept data transmitted over these networks. They can execute man-in-the-middle attacks , intercepting data exchanged between your device and the router.

This allows them to capture sensitive information such as credit card details and personal information entered during the purchase. They may also create fake Wi-Fi connections to trick you into connecting, compromising your entire device. To protect yourself, avoid using your primary credit card on public networks.

Instead, use mobile data to connect to the internet, encrypt your connection with a VPN , or make purchases only when connected to your personal or secured internet connection.

3 Using a Shared Computer

Lee Snider Photo Images/Shutterstock.com

Like public Wi-Fi, shared computers in public libraries, internet cafes, and schools usually aren’t adequately secured. Since anyone can use these devices, they are easy to compromise.

Hackers can secretly install keyloggers to capture your credit card information, install tracking software to steal data as you enter it, track your activity by remotely connecting to the device, or use other techniques to compromise your data. You might also unintentionally store your credit card information in the browser, which the next user can misuse.

Using your credit card on such devices can expose it to fraudsters. Therefore, avoid making transactions on a shared PC, and don’t access your bank account or other sensitive details. If a transaction is urgent, and you can’t access your laptop, you should use your phone. If you only have the choice to use a public PC, opt for an alternate payment method, like a virtual credit card.

4 Unreliable Merchants or Shopping Apps

Shopping with untrusted merchants or stores always poses risks, such as not receiving a product or receiving counterfeit or lower-quality items, but may also compromise your finances. Using your credit card at random stores gives them direct access to your information, which they can sell to third parties.

They can also deduct hidden charges for services you never opted for. If you save your information on their website, a breach could expose your data. To protect yourself, always use a virtual credit card when making a purchase from an untrusted merchant. Additionally, thoroughly research the store by checking reviews and the company history.

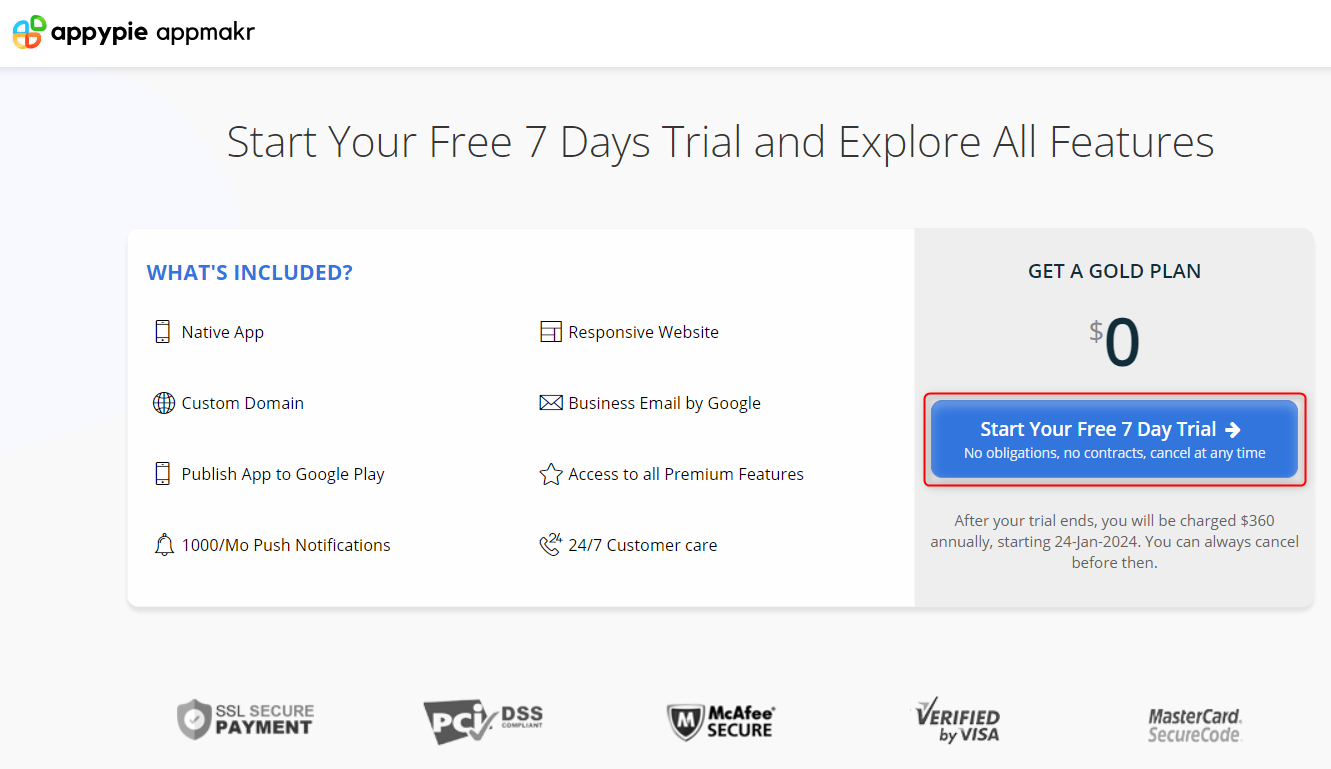

5 Trial Subscriptions

Many companies offer trial subscriptions with the promise of free access for a limited time, but they often require a credit card to activate the trial. Once the trial period ends, your card is automatically charged for a full subscription. If you forget to cancel the trial before the deadline, it is automatically converted into a paid subscription.

Some companies intentionally make it difficult to cancel the trial, and if you frequently try new services, it’s easy to forget to cancel them, leading to unexpected expenses. To avoid those problems, use a virtual card when activating a trial. You can also use a prepaid card with a limited balance to ensure you won’t be charged even if you forget to cancel.

6 Overseas Transactions

Using your primary credit card for overseas transactions, such as shopping, subscribing to services, making business payments, or traveling abroad, carries certain risks. Firstly, you might incur additional transaction fees, making the purchase 3-5% more expensive than the regular price.

When merchants charge your card in your home currency instead of the local one, hidden fees may apply. Also, the conversion rates may not be favorable, making the purchase appear more expensive in your local currency. To avoid these issues, consider getting a temporary card from a local service in the country you’re dealing with.

This way, you can exchange your currency at a reasonable rate beforehand and avoid additional fees or hidden charges. Additionally, using a temporary card allows you to avoid using your primary card linked to your bank account, mitigating the risk of a malicious actor compromising your card and depleting your funds.

7 Crowded or Unsafe Locations

If you use your credit card to shop in physical locations, especially in places like outdoor markets or less secure stores, you must be extremely cautious. These environments risk your card details being skimmed by devices attached to point-of-sale machines or ATMs, which capture your information when you swipe your card.

Shoulder surfers may steal your card details, your card could be swapped with a different one, or you might accidentally leave it vulnerable to theft. Fraudulent vendors may also overcharge your credit card without your knowledge, particularly in locations with high transaction volumes. Dealing with such issues while abroad can ruin your vacation.

To mitigate these risks, use a secondary card with a limited balance, avoid carrying your primary card, and check alerts for every transaction to ensure you haven’t been overcharged. Also, refrain from using ATMs in suspicious locations, opt for contactless payment methods when possible, and use RFID protection to prevent electronic theft.

These are some scenarios where choosing a virtual card or an alternative payment method would be prudent. By avoiding using your primary card linked to your main bank account, you can protect your funds. Also, you can sidestep the inconvenience of dealing with fraudulent transactions online and avoid the struggle to get refunds for unauthorized transactions.

While you should follow the above tips to protect your finances, raising awareness about these risks among your loved ones is equally important to ensure their protection.

Also read:

- [Updated] Unveil Clearer Visuals Essential Tips for Zooming on Snapchat

- Celebrate Independence Day with Urban Armor - Get Sitewide Savings up to 20%

- Clearing the Picture: Microsoft Aims to Improve Chrome's Text Sharpness on PC Platform

- Discover the Secret Power of Windows: Essential 6 Underutilized Tools for Enhanced Efficiency

- Does Airplane Mode Turn off GPS Location On Realme 12 Pro+ 5G? | Dr.fone

- Download the Latest: Samsung Internet Browser Brought Directly to Your Windows PC

- Easily Determine Which Java Version You're Running on Windows 10

- Easily Monitor Hard Drive Capacity on Windows 10 - A Comprehensive Tutorial

- Faites De Votre CAF Une Plateforme Web Gratuite Grâce À Movavi - Guérilla SEO

- Get Your Essential Data Protection - Acronis True Image Now at a 20% Discounted Rate!

- In 2024, Divergence in Dungeons Classic and Hybrid Games

- Industry's Heavyweight Champions - Drones of the Year for 2024

- Mastering the New Multitasking Feature: Effortless Window Tiling in Windows 11

- Navigating Through LinkedIn Account Termination Procedures

- Notepad++ Version Upgrade: New Features & Improvements Now Available!

- Pro-Win Tips: Effortlessly Switch From Word Docs to PDF on OS 11

- Remedying Windows 11 Microsoft Store Error 0X80073cf3

- Seamless Connectivity with Easy-to-Download Wireless Adapter Software

- Securely Wipe Out Important Data From Your iPhone - Expert Tips & Tools

- Title: 1. When Not to Use Your Primary Credit Card: Top 7 Situations Explained

- Author: James

- Created at : 2024-12-25 02:16:58

- Updated at : 2024-12-26 05:49:37

- Link: https://technical-tips.techidaily.com/1-when-not-to-use-your-primary-credit-card-top-7-situations-explained/

- License: This work is licensed under CC BY-NC-SA 4.0.